During 3rd quarter of 2012, Shanghai HPF operation maintained a stable and good momentum, with various main service indices reached expectation, and new progress made in using HPF value-added proceeds and fund balance with combined effort of investing and loaning to support security housing construction.

1. Accomplishments of various service indices

HPF collection: HPF and Additional HPF collected during January- September period added up to 40.256 billion yuan, with a year-on-year increase of 19.78%, including 31.027 billion yuan of HPF, equivalent to 77%; and 9.229 billion yuan of Additional HPF, equivalent to 23%. As of end of September, the accumulated collection of HPF and Additional HPF added up to 339.4 billion yuan.

HPF payment: As of end of September, the number of HPF paying units totaled 0.1316 million, with a year-on-year increase of 0.0181 million, up 15.95%. The number of paying employees totaled 4.8159 million, with a year-on-year increase of 0.4141 million, up 9.41%.

HPF Withdrawal: HPF withdrawal during January-September period amounted to 21.801 billion yuan, with a year-on-year increase of 15.07%, including withdrawal due to housing consumption totaling 16.826 billion yuan with a year-on-year increase of 11.87%; withdrawal due to reasons such as retirement totaling 4.975 billion yuan with a year-on-year increase of 27.38%. As of end of September, the accumulated HPF withdrawal amounted to 187.6 billion yuan, equivalent to 55% of the accumulated HPF collection.

HPF home loans: HPF home loans issued during January-September period totaled 29.071 billion yuan with a year-on-year increase of 39.96%, for a toal of 0.0808 million households with a year-on-year increase of 40.28%, including 3.83 billion yuan of home loans issued for purchase of affordable housing (0.0153 million households) during the January-September period. As of end of September, the balance of HPF home loans was 134.128 billion yuan, an increase of 13.817 billion yuan from the beginning of this year. The accumulated HPF home loans issued amounted to 288.9 billion yuan for a total of 1.6444 million households, and a total building area of 149 million square meters.

HPF loan risks: By end of September, the HPF home loans delinquency rate was 0.103‰

HPF value-added proceeds: HPF service revenues during January-September period totaled 5.268 billion yuan. Service expenses accounted for 2.816 billion yuan. Value-added proceeds realized totaled 2.452 billion, showing a year-on-year increase of 139.92%.

1. Characteristics of Shanghai HPF operation during 3rd quarter:

(1) The fast increase in the number of paying employees and monthly payment amount resulted in synchronous rise in HPF collection in the 3rd quarter.

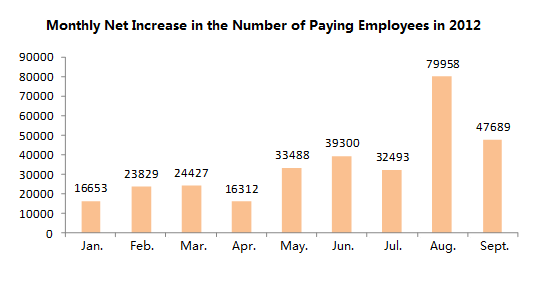

HPF collected in this quarter totaled 14.851 billion yuan, with a year-on-year increase of 21% and a quarter-on-quarter increase of 17% respectively over the first and the second. The fast increase in HPF collection during this quarter attributed mainly to the increase in the number of paying employees. The net increase in the number of paying employees during 3rd quarter was 0.1601 million, accounting for 51% of the entire net increase in the number of paying employees during 1st-3rd quarter period, with the monthly net increase in the number of paying employees in 2012 shown as follows:

The fast increase in the number of paying employees in this quarter mainly resulted from college graduates’ starting their job careers in succession, and SPFMC’s administrative law enforcement measures on inspection of liable unregistered units for compliance and other new measures such as additional payment outlets, internet-based payment and commissioned deduction, which provided great convenience to paying units and thus boosted their motivation in normal HPF payment. The second reason for the fast increase was the increase of monthly payment amount after payment base adjustment. Starting from July, the payment base for calculation of monthly payment amount was adjusted from year 2010’s average monthly salaries to year 2011’s average monthly salaries. Relevant data from Shanghai Statistical Bureau indicated the average monthly salary of employees of the municipality in 2011 increased 11% over 2010. While the payment rate remains unchanged, the increase in average monthly salaries caused the increase in monthly payment amount in the new year.

(2) Size of home loans issued rising during the quarter and falling at end of the quarter, with structure of home loans further improved.

Restraint of rigid housing demand was released in 3rd quarter as a result of implementation of policies such as the central bank’s unprecedented initiation of interest rate decrease in June in two consecutive months for the first time within three and a half years and commercial banks’ further expansion of the scope for preferential interest rates for primary home loans. Housing transactions of the municipality revealed a month-on-month and year-on-year increasing trend. Home loans demand increased significantly, hence home loans issued in 3rd quarter showed a rising trend.

At end of July, the nation conducted a special inspection of implementation of real estate regulatory policies and measures. The municipality stressed on further strict execution of all regulatory policies for real estate market. During July-September period, monthly HPF home loans were 3.87 billion yuan, 5.115 billion yuan and 4.583 billion yuan respectively, which showed rising during the quarter and falling at end of the quarter.

Home loans structural analysis showed HPF home loans of the municipality in 3rd quarter mainly supported two cohorts of home purchasers. One cohort comprised borrowers for purchase of security housing with part ownership of property rights (affordable housing). Quarterly home loans issued for purchase of security housing with part ownership of property rights in 1st -3rd quarter period amounted to 1.461 billion yuan, 1.282 billion yuan and 1.083 billion yuan respectively according to the batch arrangement based on the home purchase plan for security housing with part ownership of property rights, accounting for 24%, 14% and 8% of the quarterly home loans respectively. The accumulated HPF home loans issued for security housing with part ownership of property rights in the three quarters totaled 3.83 billion yuan, covering 13% of the total HPF home loans comparing with 0.37% for same period of last year, which contributed to a total of 15300 households’ purchase of security housing with part ownership of property rights, accounting for 55% of the aggregate purchasing households. The other cohort comprised borrowers for purchase of self-occupied primary residences. After deduction of home loans for security housing, it showed a stable demand for primary residences. Home loans for primary residences continued to increase to 92% of the entire home loans from 91% for same period of last year. This structural change in the rate embodied HPF’s compliance and conformity with the policies of differentiated loans and proactive support to self-occupied and/or improvement-oriented home purchase.

£¨3£©New progress was made in the public rental housing project. The loans for construction of second batch of security housing was approved, with a combination of investment and loans measures to bring into full play the use of HPF in securing housing.

In the 3rd quarter, new breakthrough was made in investing HPF value-added proceeds in public rental housing construction. At the beginning of the year, the public rental housing at Shang Jing Yuan was officially disclosed to the public for leasing. With the support of relevant authorities of the municipality, continuous effort was made to improve the leasing policies. Promotional campaign was launched to enhance dissemination, and flexible and differentiated leasing means adopted to include both individual and unit leaseholders. Up till the present, 1532 qualified employee households have signed the contracts, with an occupancy rate of 70%. In September, SPFMC purchased another investment public rental housing complex at Jing Hua Fang of Shanghai Jing Cheng using HPF value-added proceeds. Currently this project is already made available for delivery and use.

As new progress was made in public rental housing investment and management, the second batch of loans for construction of securing housing applied for by the municipality was ratified in the 3rd quarter by the nation’s three ministries including Ministry of Housing and Urban-Rural Development, as per requirements of Announcement on Expanding Pilot Scope of Using HPF Loans in Support of Construction of Securing Housing issued by Ministry of Housing and Urban-Rural Development, Ministry of Financial Administration and the People’s Bank. The total investment ratified was 17.548 billion yuan. The total HPF loans was 11.362 billion yuan. Contracts were successfully signed in September for six loans projects eligible for fund issuing, with a total amount of 6.67 billion yuan. The fund issuing of the second batch of HPF loans in support of security housing indicated a new step forward toward expansion of pilot scope of HPF loans to support construction of security housing in Shanghai.

3. Current Major Issues :

(1) Continue implementation of real estate macro regulatory polices to proactively prop up security housing consumption. Currently the real estate market remains at a critical stage in implementation of the macro regulatory policies. The municipality will continue execution of various policies for regulation of the real estate market, strictly administer policies on differentiated loans, and bolster HPF paying employees’ self-occupied and improvement-oriented housing consumption, particularly the demand for purchase of security housing.

(2) Proactively materialize pilot expansion of HPF in support of construction of security housing to bring the use of HPF into play. In the 4th quarter, SPFMC will be prepared to undertake the contract signing for and issuing of loans on pilot scope expansion of HPF in support of construction of security housing, as per Announcement on Expanding Pilot Scope of Using HPF Loans in Support of Construction of Securing Housing issued by ministries and commissions such as Ministry of Housing and Urban-Rural Development, to ensure normative and timely issuing of loans, and bring into play better use of HPF balance in bolstering security housing construction.

(3) Continue to unfold new measures of HPF services for convenience of paying employees. After execution of service measures including expanded HPF payment means and open commitment of service outlets, SPFMC will successively promote new measures for convenient services to the citizens in the 4th quarter. One measure is to extend service work time to a six-day workweek schedule of some service outlets of SPFMC, Bank of Construction and SEG for more convenient handling of HPF affairs, as per requirements of Proposals on Implementation of Extending Service Work Time of Public Service Outlets of Government Working Departments of the Municipality (Trial). The other measure is to open HPF Hotline 12329 effective as of November 1 as per requirements of Notice of Ministry of Housing and Urban-Rural Development on Opening of HPF Hotline 12329. The Hotline will mainly resort to human voice to provide extension services by means of human voices and self-service such as service instructions, queries, and submission handling, as well as basic services including consultation, customer complaints resolutions and suggestions, and customer feedback survey.

Shanghai Provident Fund Management Center

October 2012